Accounting Which Table to Use for Net Present Value

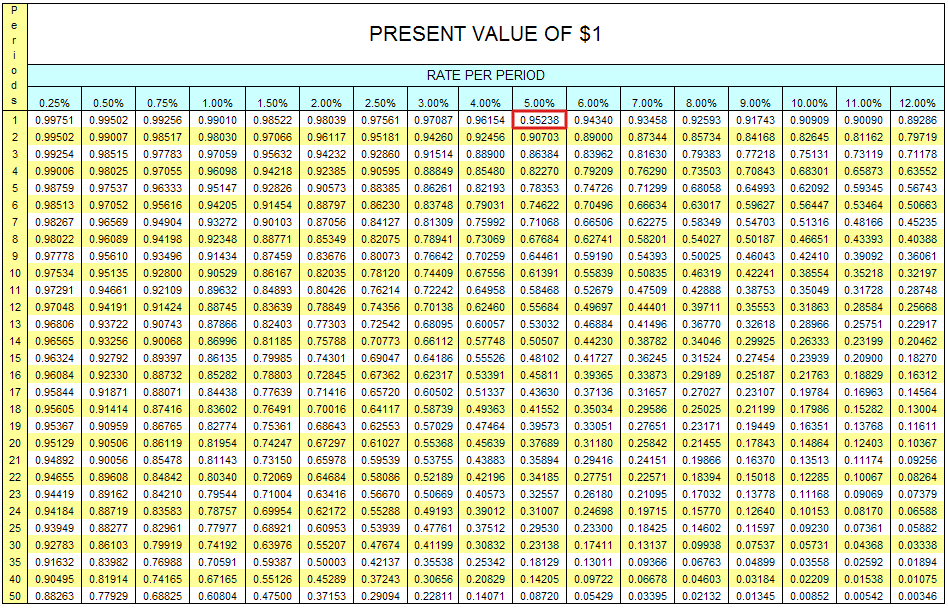

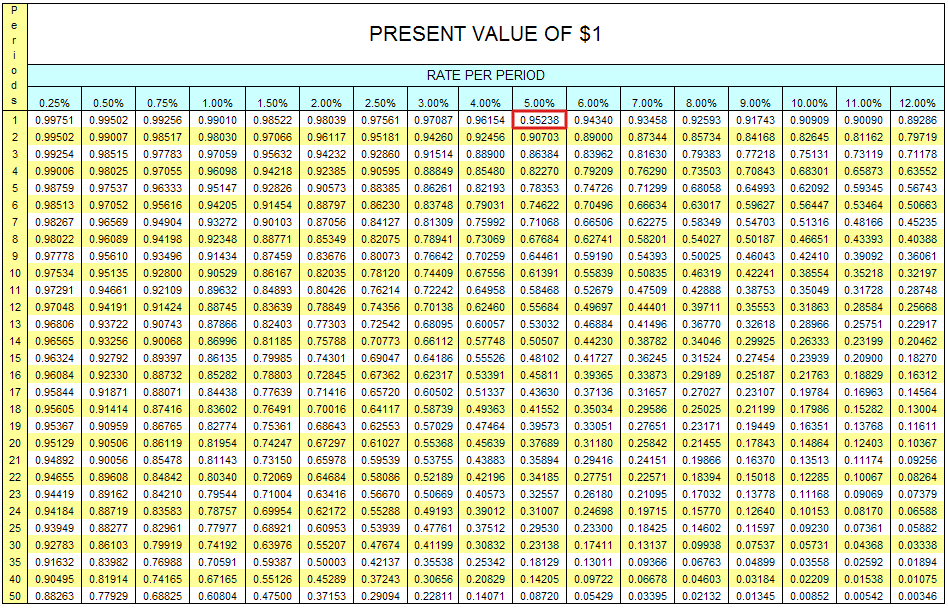

N number of periods until payment or receipt. A present value table is a tool that helps analysts calculate the PV of an amount of money by multiplying it by a coefficient found on the table.

Payback And Present Value Techniques Accountingcoach

Here is the net present value calculation.

. Present Value Tables Figure 171 Present Value of 1. Many also call it a present value factor. It leads to.

A point to note is that the PV table represents the part of the PV formula in bold above 1 1 in. Assume that there is no salvage value at the end of the project and that the required rate of return is 8. The negative NPV means the investment will be rejected.

PV FV 1 i n. This means that the machine will not only pay for itself it will also make 537350. You can view a present value of an ordinary annuity table by clicking PVOA Table.

A discount rate selected from this table is then multiplied by a cash sum to be received at a future date to arrive at its present value. R Discount rate. X 0 Cash outflow in time 0 ie.

To compute the final NPV one needs to decrease the initial outlay from the value obtained from the NPV formula. As you can see the net present value of this machine is 537350. Value for calculating the present value is PV FV 1 1 in.

NPV analysis is used to help determine how much an investment project or any series of cash flows is worth. Using the preceding formula if there is an expectation of receiving 150000 in one year and the current discount rate is assumed to be 10 then the calculated net present value of the future cash receipt is. In other words it is a table that illustrates the different coefficients that can be used to calculate a figures present value depending on the discount rate and period of time used.

The companys required rate of return is 11 percent. Use Excel to calculate the net present value of this investment in a format similar to the one in the Computer Application box in the chapter. Using the PVOA Table.

N P V 5 0 0 1 0. A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. The present value of the 20000 cash inflows occurring at the end of 7 years is 89730 30000 X 2991.

Here i is the discount rate and n is the period. An investment costing 200000 today will result in cash savings of 85000 per year for 3 years. PRESENT VALUE TABLE.

The interest rate selected in the table can be based on the current amount the investor is obtaining. The purchase price initial investment Why is Net Present Value NPV Analysis Used. Net Present Value Calculation Using Excel.

13 Using Financial Accounting for Wise Decision Making. 1 r n Periods Interest rates r n. 71 Accounts Receivable and Net Realizable Value.

PV FV x 1 1 in. Net present value method also known as discounted cash flow method is a popular capital budgeting technique that takes into account the time value of moneyIt uses net present value of the investment project as the base to accept or reject a proposed investment in projects like purchase of new equipment purchase of inventory expansion or addition of. We also explain what the Net Present Value is why it is calculated and how to explaininte.

Z 2 Cash flow in time 2. The NPV of the project is calculated as follows. If you dont have access to an electronic financial calculator or software an easy way to calculate present value amounts is to use present value tables.

The result of the NPV formula for the above example comes to 722169. 0 8 1 3 0. 72 Accounting for Uncollectible Accounts.

In this lesson we go through a great example of calculating NPV. The formula for Net Present Value is. This can be re written as.

The general rule of thumb is that if the net present value of an investment or capital purchase is greater or equal to zero it is a good investment. PV tables are used to provide a solution for the part of the present value formula shown in red this is sometimes referred to as the present. Present value -----------------.

Download this accounting example in excel. Therefore the combination of the present values of the cash flows results in a net present value NPV of negative 10270 negative PV of 100000 positive PV of 89730. Z 1 Cash flow in time 1.

Present value of 1 that is where r interest rate. The present value formula is.

What Is A Present Value Table Definition Meaning Example

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Comments

Post a Comment